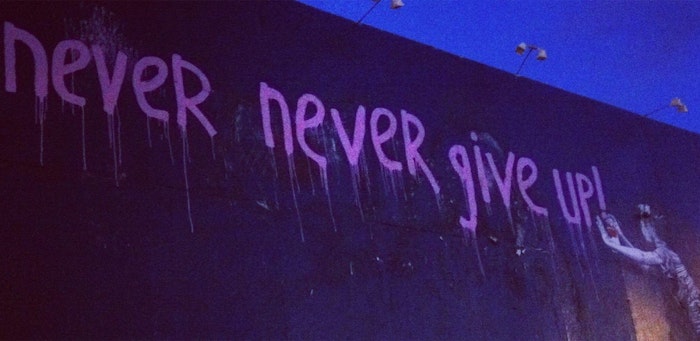

DALL·E 2 Generations in the style of Banksy

Testing Banksy-style prompts in DALL·E 2, Ed explored "New graffiti by Banksy", anti-environmentalism, pro-consumerism, and a Biden campaign poster, plus a Banksy-inspired McDonald’s logo; GPT-3 refined prompts, yielding images like capitalism critique with bright colors and Ronald McDonald skeletons, though some prompts triggered policy warnings.